Which is the most liquid company on the Bulgarian Stock Exchange over the past 12 months, and why is this important?

28 apr 2025

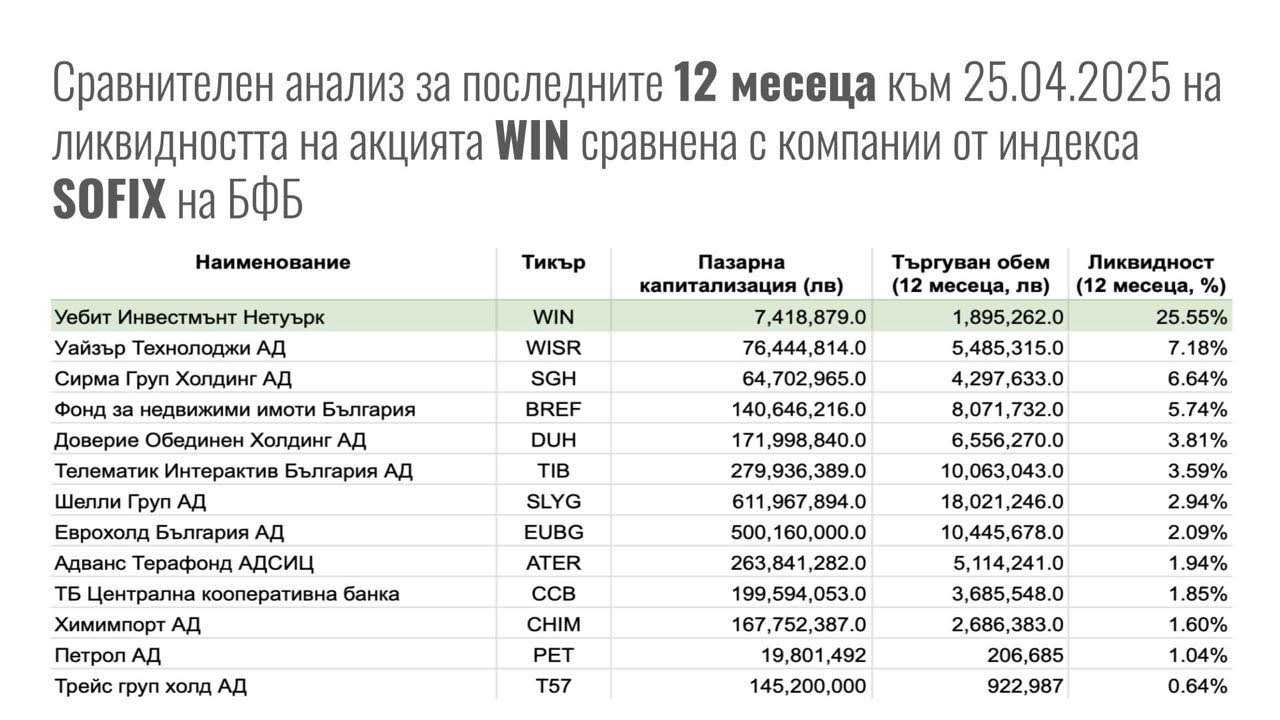

As of April 25, 2025, the shares of Webit Investment Network (ticker: WIN) show a liquidity of 25.55% over the past 12 months – one of the highest values among all companies included in the SOFIX index of the Bulgarian Stock Exchange. This positions WIN as a clear leader by this metric, significantly outperforming even companies with market capitalizations dozens or hundreds of times larger than its own.

What is liquidity and why is it important for investors?

The liquidity of a public company shows the proportion of traded shares relative to its market capitalization over a certain period of time. This metric is key for investors because:

- It enables easy entry and exit from positions without significant price deviations;

- It reduces the risk of high volatility during active trading;

- It increases the attractiveness of the shares for institutional and long-term investors seeking transparency and sufficient market volume.

Comparative analysis relative to SOFIX

Data shows that the next most liquid company – Wiser Technology AD – has a significantly lower rate of 7.18%, while most companies in the index operate in the range between 0.64% and 6.64%. At the same time, WIN’s market capitalization stands at BGN 7.4 million, while other companies with over 100 times larger market values – like Shelly Group AD (BGN 612 million) and Eurohold Bulgaria AD (BGN 500 million) – register only 3 to 5 times higher trading volumes.

This ratio highlights extremely high market activity relative to the actual size of the company – a rare phenomenon in the context of the BSE, and often indicative of:

- Increased interest from individual and institutional investors;

- Significant liquidity with low capitalization – a factor that can catalyze future growth;

- Market efficiency and trust, expressed through active trading.

Market implications

The observed dynamics around WIN have several important implications for the capital market:

- Such liquidity at low capitalization creates an extremely favorable environment for new and active investors seeking high tradability opportunities with strong growth potential;

- WIN is establishing itself as one of the most liquid instruments on the BSE, which matters not only for trading but also for forming a fair market valuation;

- This signals a possible upcoming expansion of the investor base, including international investors.

Conclusion

Webit Investment Network (WIN) demonstrates a market behavior pattern combining high liquidity with relatively small capitalization – a rare and highly positive combination on capital markets. This positions the company as one of the most actively traded on the BSE, with potential for future recapitalization, expansion of shareholder structure, and establishment among the leading public companies in the region.

Summary

Companies with market capitalizations exceeding WIN’s by a hundredfold generate just 2 to 5 times more trading volume compared to WIN.

This represents a significant market paradox.

Over the past 12 months, more than 25% of WIN’s capitalization has been traded, with the respective shares changing ownership. We assume this dynamic is due to short-term investors and speculative positions that have already been cleared from the shareholder structure.

This trend suggests an increase in the share of long-term investors in WIN, which would lead to further limited supply of shares on the market.

As a result, if interest in the company is maintained or increases, the reduced supply could exert upward pressure on the stock price in the future.

Disclaimer:

This article should not be considered a recommendation from an independent third party. Historical performance is not indicative of future gains. All investments in stocks carry risk, including partial or total loss of capital. Investors should perform their own analysis and consult professional advisors. WIN is not responsible for any losses resulting from decisions based on this public information.